Create an Amazing Newspaper

Stay Updated

Explore

Understanding the Corporate Transparency Act (CTA)

The meaning of the Corporate Transparency Act (CTA) is a law aimed at increasing the transparency of company information in the United States. This law aims to prevent money laundering, terrorism financing and other financial crimes by requiring companies to report who the true owners of the company are to the relevant government authorities. The primary goal of the CTA…

Understanding Sharia Economics and Conventional Economics

Sharia economics is an economic system whose principles and operations are based on Islamic law or Sharia. The uniqueness of sharia economics lies in the strict prohibition against the practice of riba (interest), which is considered detrimental and unfair in financial transactions. In addition, sharia economics also prohibits gharar (uncertainty) and maysir (speculation), which can often lead to economic instability.…

Understanding Cloud Mining

Cloud mining is a concept that allows individuals to participate in cryptocurrency mining without the need to purchase and manage…

Understanding Advance Pricing Agreement (APA)

As an introduction, the Advance Pricing Agreement (APA) is one of the instruments used in transfer pricing in the world…

The Three Elements of the Blockchain Trilemma

The Blockchain Trilemma is a concept that describes three main, interrelated aspects of blockchain technology, namely decentralization, security and scalability.…

More Stories

Components and Functions of Querycal Jobs

Introduction to Querycal Jobs In a world surrounded by data, having insight into Querycal Jobs has become a necessity. Querycal Jobs can be defined as work related to implementing, handling, and optimizing queries in a database management system. These tasks are important to ensure that necessary information can be accessed…

Krugerrand Coin Design and Characteristics

Introduction to the Krugerrand The Krugerrand is a gold coin that was first introduced to the global market as a practical and tradable gold investment vehicle. Invented in 1967 by the South African Government, this coin was created with the aim of promoting gold mined in the country and making…

The importance of adaptation in forex trading strategies

Introduction: Explains the importance of adaptation in forex trading strategies In the world of forex trading, adaptation is an important key to surviving and generating profits in a market full of uncertainty. Forex market volatility is often the main topic in every financial analysis because it can provide high profit…

Understanding Sharia Economics and Conventional Economics

Sharia economics is an economic system whose principles and operations are based on Islamic law or Sharia. The uniqueness of sharia economics lies in the strict prohibition against the practice of riba (interest), which is considered detrimental and unfair in financial transactions. In addition, sharia economics also prohibits gharar (uncertainty)…

Introduction to Accelerated Cost Recovery Systems

The Accelerated Cost Recovery System (ACRS) is a depreciation mechanism introduced in the United States tax code through the Economic Recovery Tax Act of 1981. This system is designed to speed up the process of recovering investment costs on certain assets belonging to a business. The goal of ACRS is…

Industry Position and its Relationship to Market Share

Understanding Market Share Market share is a term used to refer to a specific share of total demand in an industry or product category controlled by a company. It is an important indicator of a company's relative position in the market compared to its competitors. Measuring market share can help…

Understanding Cloud Mining

Cloud mining is a concept that allows individuals to participate in cryptocurrency mining without the need to purchase and manage their own mining hardware. In simple terms, cloud mining leverages the computing power provided by data centers that run dedicated mining hardware on behalf of users. By paying a service…

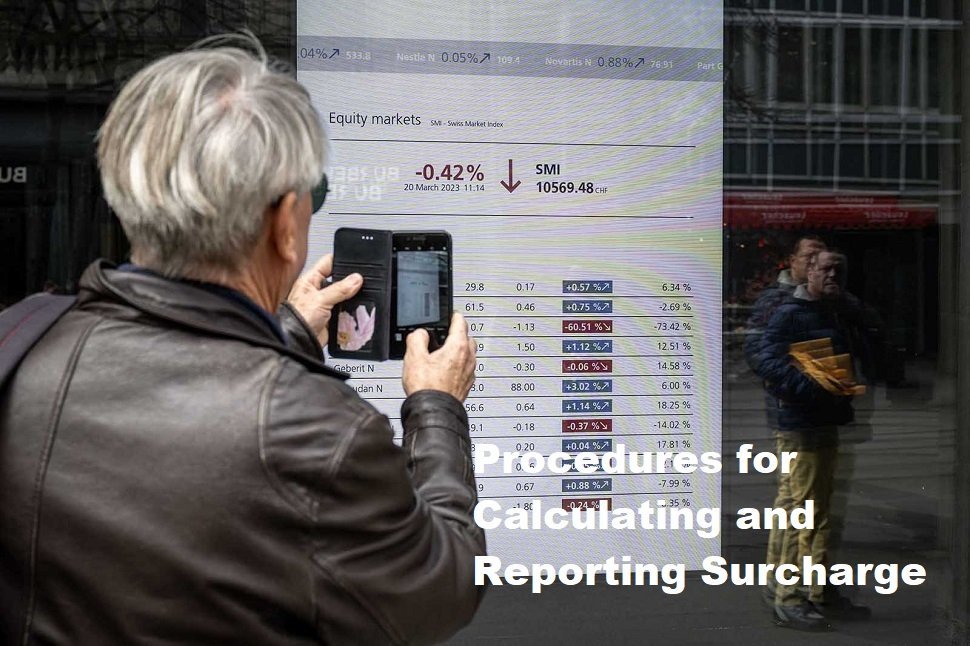

Procedures for Calculating and Reporting Surcharge

Understanding Surcharge Surcharge is a term commonly used in the field of taxation, and can be interpreted as an addition imposed on top of the existing tax rate. The basic concept of Surcharge comes from the government's need to collect more income in order to finance state activities or certain…

Recognition and Measurement of Deferred Assets

Deferred assets, also known as deferred assets, are a concept in accounting that refers to expenses or costs that have been paid or received, but cannot yet be recognized as assets in the applicable reporting period. Recognition of these assets is delayed because the costs will provide economic benefits in…

Differentiation of the Bertrand Edgeworth Model from the Bertrand and Cournot Model

Introduction and Definition of the Bertrand Edgeworth Model Bertrand Edgeworth's model is one of the fundamental concepts in industrial economics that was developed at the end of the 19th century. This model was created by two prominent economic theorists, Joseph Bertrand and Francis Ysidro Edgeworth, who worked independently of each…

Most Popular

Sanae Takaichi Made History as Japan’s First Female Prime Minister

On October 21, 2025, Japan entered a new chapter in its political history as Sanae…

Consequences of Zero-Sum Games in Economics

Definition of "Zero-Sum Game" Zero-sum games are a concept in game theory and economics that…

Measuring Depreciation Adequacy

Definition of Depreciation Adequacy Depreciation adequacy is an important concept in the financial sector related…

The Role of Quote Currency in Transactions

Understanding Quote Currency Understanding quote currency is an important concept in the world of trading,…