Create an Amazing Newspaper

Stay Updated

Explore

How to Reduce Unsystematic Risk

Unsystematic Risk is a risk that arises as a result of problems or events that are directly related to a particular company or industrial sector. This risk is specific and does not affect the entire market as a whole. Unsystematic Risk consists of various factors that can influence a company's performance, such as poor management capabilities, internal crises, changes in…

Probability Concept in Expected Payoff

Definition of Expected Payoff Expected Payoff is an important concept in the theory of decision making under uncertainty, which is used to calculate the average payoff of the alternatives faced by the decision maker. In…

Recognition and Measurement of Deferred Assets

Deferred assets, also known as deferred assets, are a concept in accounting that refers to expenses or costs that have been paid or received, but cannot yet be recognized as assets in the applicable reporting…

It’s Not About Capital, Here Are 4 Traits of Successful Investors That Everyone Can Possess

When starting to invest, many people assume that having a large amount of capital is the key to success. While this isn't entirely wrong, there are many other, more important aspects of investing that can…

Process and recovery from stock suspension

Share suspension is a policy known in the capital market, where trading in a company's shares is temporarily suspended by the stock exchange authority. This is usually done to protect investors and avoid price manipulation.…

Your Path to Financial Freedom Starts Here

Special Features

Application of Point Elasticity in Business and Economics

Definition of Point Elasticity Point Elasticity is a concept in economics that measures the sensitivity of demand or supply to…

Introduction to the Greenback and USD

Greenback is a term originating in the United States to designate dollar bills that began to be issued during the…

Did the Fire in LA Affect the Dollar Exchange Rate?

Background to the Los Angeles Fire The large fire that occurred in Los Angeles started on January 7, 2025 and…

Golden Visa Programs General Process and Requirements

Definition and Concept of Golden Visa Programs Golden Visa Programs are special immigration programs offered by several countries with the…

More Stories

The importance of adaptation in forex trading strategies

Introduction: Explains the importance of adaptation in forex trading strategies In the world of forex trading, adaptation is an important key to surviving and generating profits in a market full of uncertainty. Forex market volatility is often the main topic in every financial analysis because it can provide high profit…

The Role of Quote Currency in Transactions

Understanding Quote Currency Understanding quote currency is an important concept in the world of trading, especially in the foreign exchange or forex market. Quote currency, also known as counter currency, is the second currency displayed in a currency pair. A currency pair consists of two currencies that are interconnected and…

Debt Amortization Trading Mechanism

Debt Amortization Trading is a concept in the world of finance that is related to the systematic reduction in the value of debt or loans over time. The main idea behind debt amortization trading is to arrange payments that include part of the principal and part of the interest, which…

Behavioral Theories in Oligopoly

Oligopoly is a form of market structure found in the world economy, where there is a small number of companies or producers that dominate an industry or market. This market structure is somewhere between a monopolistic market structure and perfect competition, with a few firms having significant control over the…

Understanding Sharia Economics and Conventional Economics

Sharia economics is an economic system whose principles and operations are based on Islamic law or Sharia. The uniqueness of sharia economics lies in the strict prohibition against the practice of riba (interest), which is considered detrimental and unfair in financial transactions. In addition, sharia economics also prohibits gharar (uncertainty)…

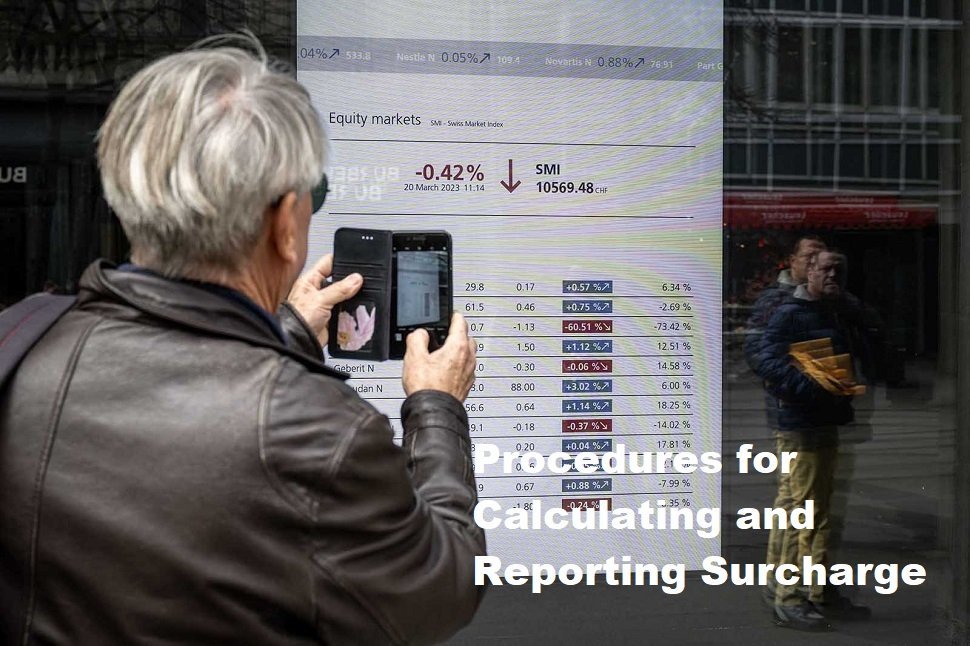

Procedures for Calculating and Reporting Surcharge

Understanding Surcharge Surcharge is a term commonly used in the field of taxation, and can be interpreted as an addition imposed on top of the existing tax rate. The basic concept of Surcharge comes from the government's need to collect more income in order to finance state activities or certain…

Introduction to the Greenback and USD

Greenback is a term originating in the United States to designate dollar bills that began to be issued during the American Civil War. Established in 1862, 'greenback' refers to banknotes issued by the US government that have green on the back. This term was popularized because almost all banknotes at…

Components and Functions of Querycal Jobs

Introduction to Querycal Jobs In a world surrounded by data, having insight into Querycal Jobs has become a necessity. Querycal Jobs can be defined as work related to implementing, handling, and optimizing queries in a database management system. These tasks are important to ensure that necessary information can be accessed…

Most Popular

Golden Visa Programs General Process and Requirements

Definition and Concept of Golden Visa Programs Golden Visa Programs are special immigration programs offered…

Financial Modeling Test

Financial modeling test is a financial analysis process that involves creating a mathematical model that…

Impact and potential risks from Counterparty Risk

Counterparty risk is the risk associated with the possibility of the counterparty to a contract…

Krugerrand Coin Design and Characteristics

Introduction to the Krugerrand The Krugerrand is a gold coin that was first introduced to…